What To Expect From the Housing Market in 2023

The 2022 housing market has been defined by two key things: inflation and rapidly rising mortgage rates. And in many ways, it's put the market into a reset position.

As the Federal Reserve (the Fed) made moves this year to try to lower inflation, mortgage rates more than doubled – something that’s never happened before in a calendar year. This had a cascading impact on buyer activity, the balance between supply and demand, and ultimately home prices. And as all those things changed, some buyers and sellers put their plans on hold and decided to wait until the market felt a bit more predictable.

But what does that mean for next year? What everyone really wants is more stability in the market in 2023. For that to happen we’ll need to see the Fed bring inflation down even more and keep it there. Here’s what housing market experts say we can expect next year.

What’s Ahead for Mortgage Rates in 2023?

Moving forward, experts agree it’s still going to be all about inflation. If inflation is high, mortgage rates will be as well. But if inflation continues to fall, mortgage rates will likely respond. While there may be early signs inflation is easing as we round out this year, we’re not out of the woods just yet. Inflation is still something to watch in 2023.

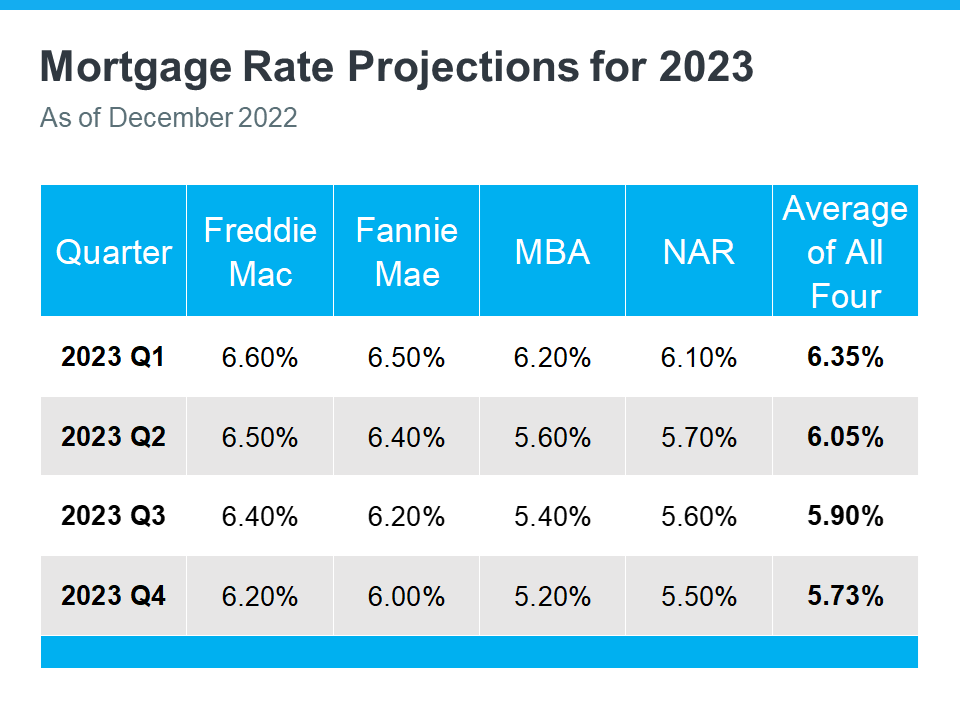

Right now, experts are factoring all of this into their mortgage rate forecasts for next year. And if we average those forecasts together, experts say we can expect rates to stabilize a bit more in 2023. Whether that’s between 5.5% and 6.5%, it’s hard for experts to say exactly where they’ll land. But based on the average of their projections, a more predictable rate is likely ahead (see chart below):

That means, we’ll start the year out about where we are right now. But we could see rates tick down if inflation continues to drop. As Greg McBride, Chief Financial Analyst at Bankrate, explains:

“. . . mortgage rates could pull back meaningfully next year if inflation pressures ease.”

In the meantime, expect some volatility as rates will likely fluctuate in the weeks ahead. If we see inflation come back under control, that would be good news for the housing market.

What Will Happen to Home Prices Next Year?

Homes prices will always be defined by supply and demand. The more buyers and fewer homes there are on the market, the more home prices will rise. And that’s exactly what we saw during the pandemic.

But this year, things changed. We’ve seen home prices moderate and housing supply grow as buyer demand pulled back due to higher mortgage rates. The level of moderation has varied by local area – with the biggest changes happening in overheated markets. But do experts think that will continue?

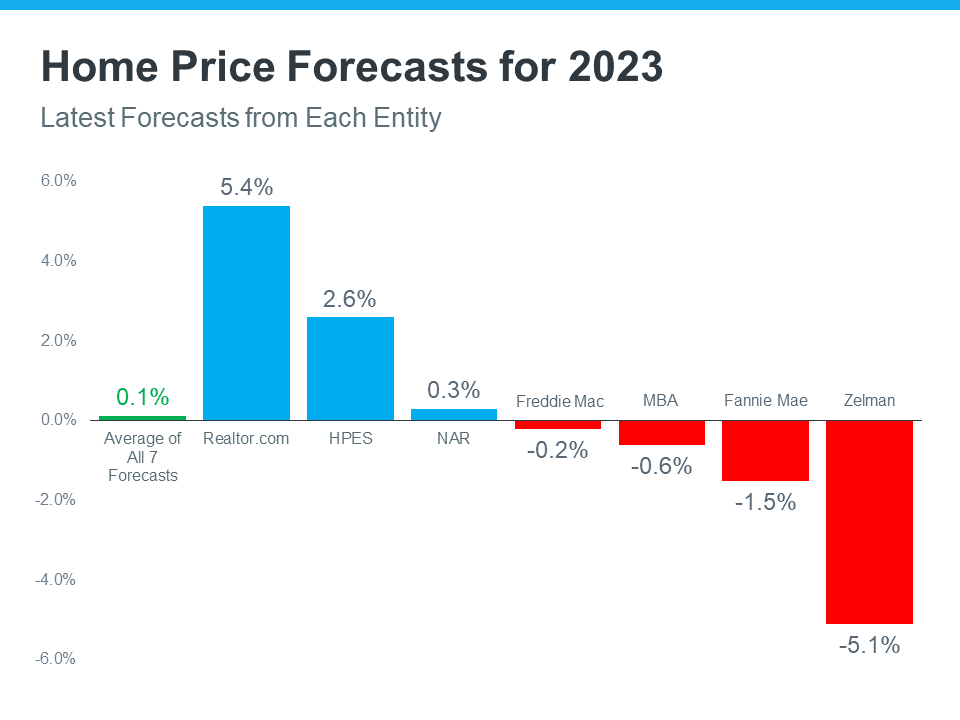

The graph below shows the latest home price forecasts for 2023. As the different colored bars indicate, some experts are saying home prices will appreciate next year, and others are saying home prices will come down. But again, if we take the average of all the forecasts (shown in green), we can get a feel for what 2023 may hold.

The truth is probably somewhere in the middle. That means nationally, we’ll likely see relatively flat or neutral appreciation in 2023. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“After a big boom over the past two years, there will essentially be no change nationally . . . Half of the country may experience small price gains, while the other half may see slight price declines.”

Bottom Line

The 2023 housing market is going to be defined by mortgage rates, and rates will be determined by what happens with inflation. The best way to keep a pulse on what experts are projecting for next year is to lean on a trusted real estate advisor. Let’s connect.