http://bit.ly/2NiLnoh

Mortgage Rates Surge Well Into New 7-Year Highs

Mortgage rates skyrocketed today, in relative terms. It was the single worst day in nearly 2 years, and among only a few days where effective rates moved more than 0.10%. Typically, mortgage rates are offered in 0.125% increments. We're able to track "effective rates" by examining the upfront costs associated with any given rate. For instance, a quoted rate might not change from day today despite major changes in upfront costs/credits. At a certain point, the upfront cost change is big enough that it makes more sense to jump up by the aforementioned 0.125% increment.

In other words, if you have a loan in process, an effective rate increase of 0.10% means there's a very good chance that you're looking at a 0.125% increase in rate today. And if you're not, you'd instead be seeing this move in the form of higher upfront costs or lower lender credit. Either way, it was a big, bad move.

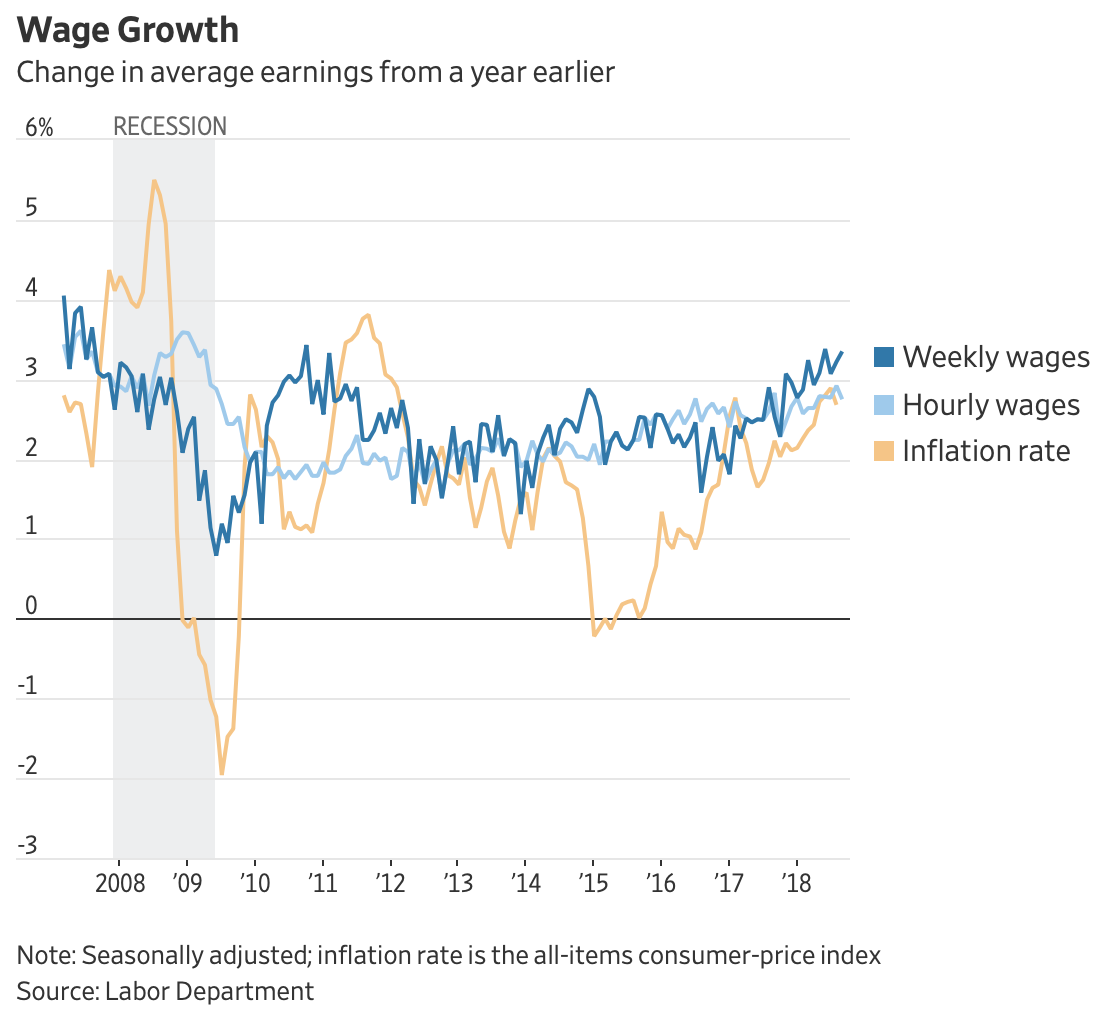

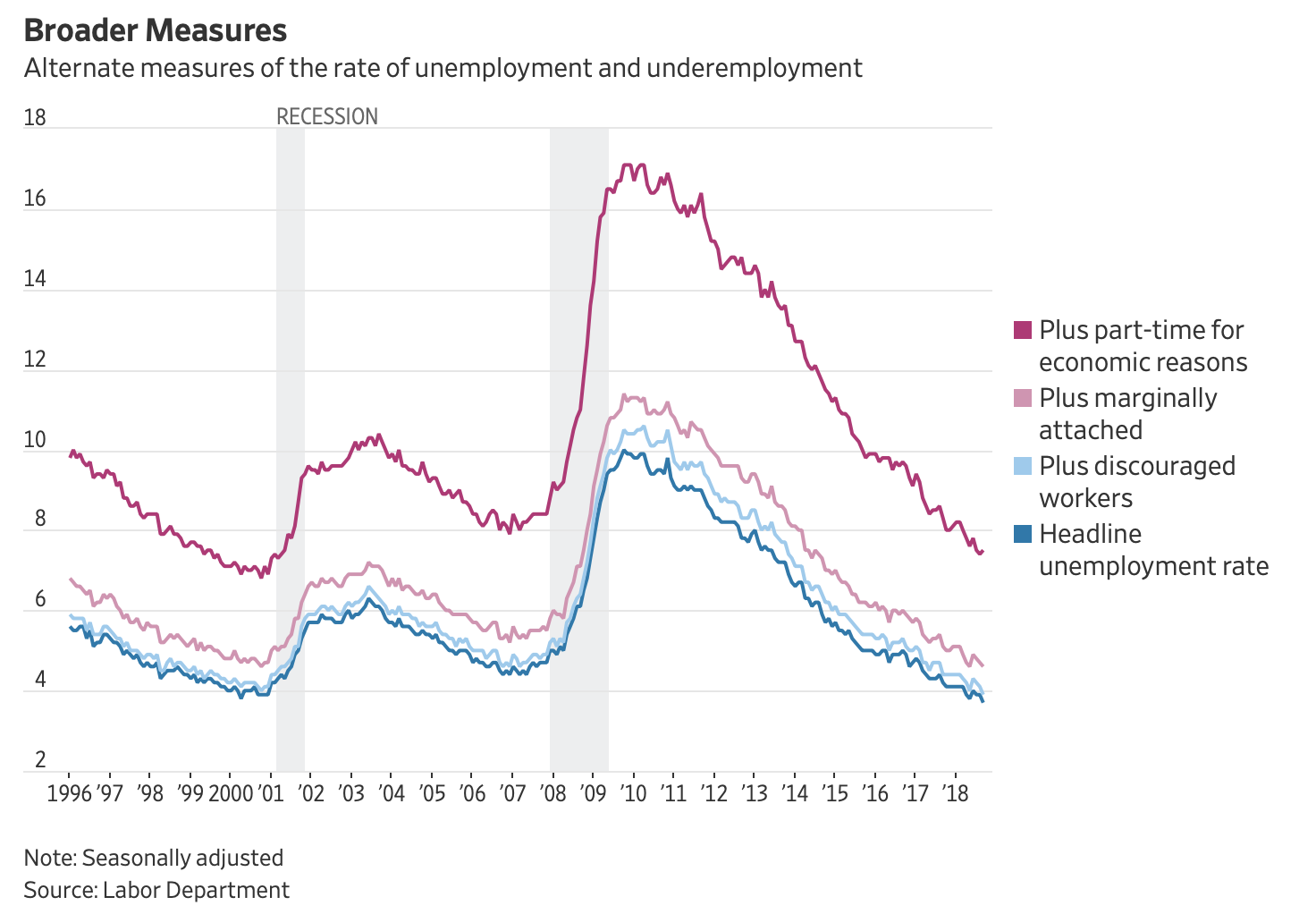

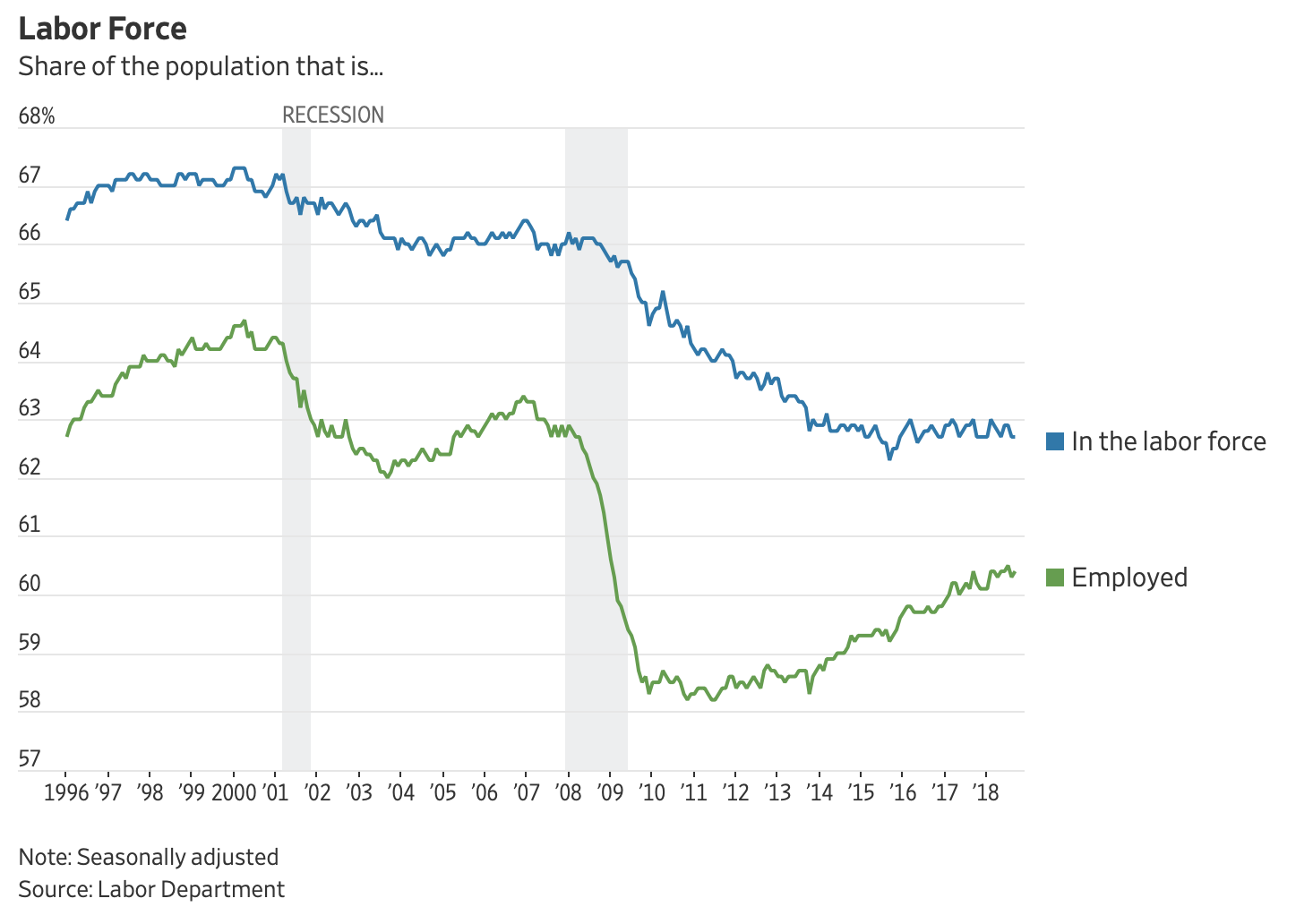

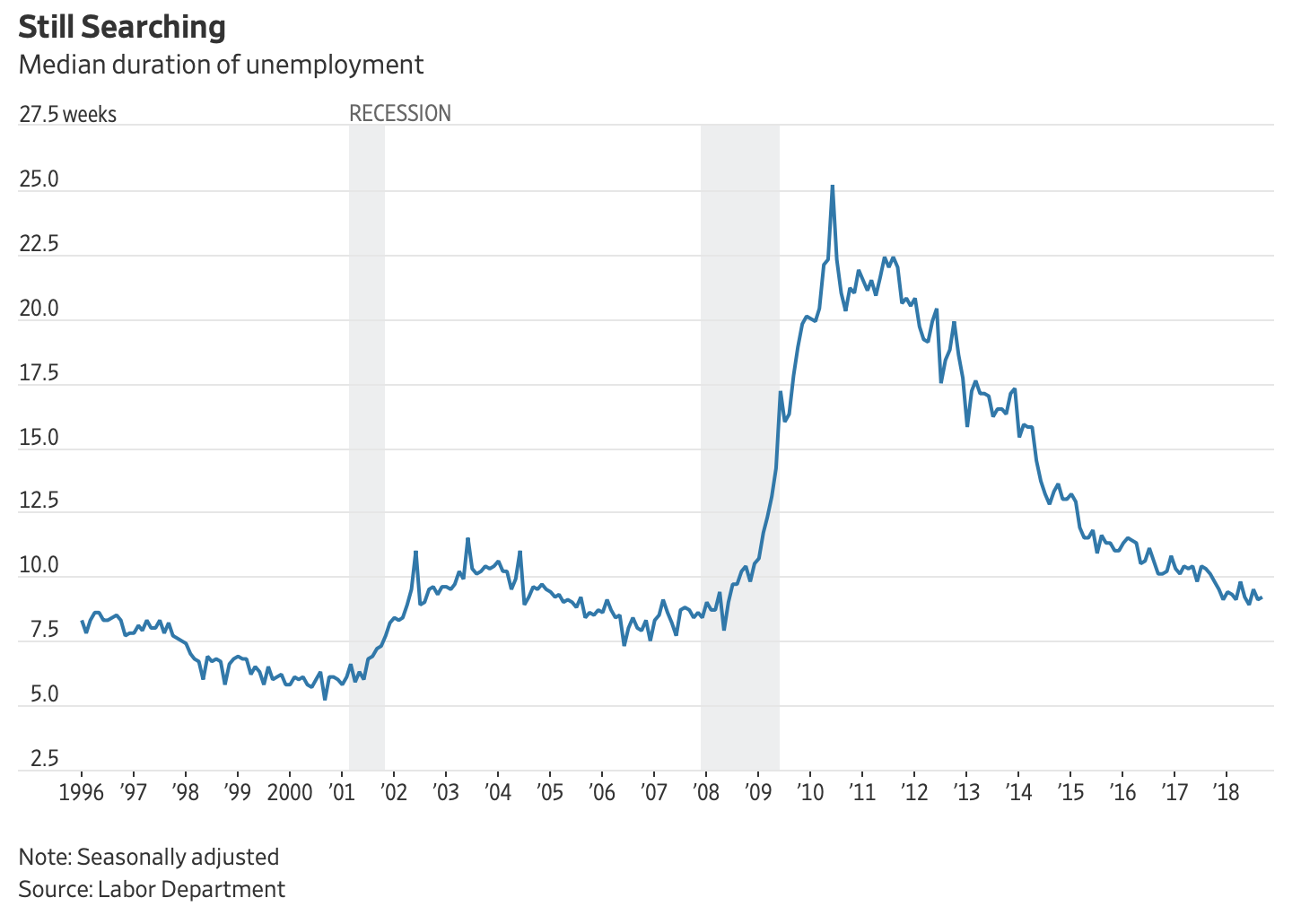

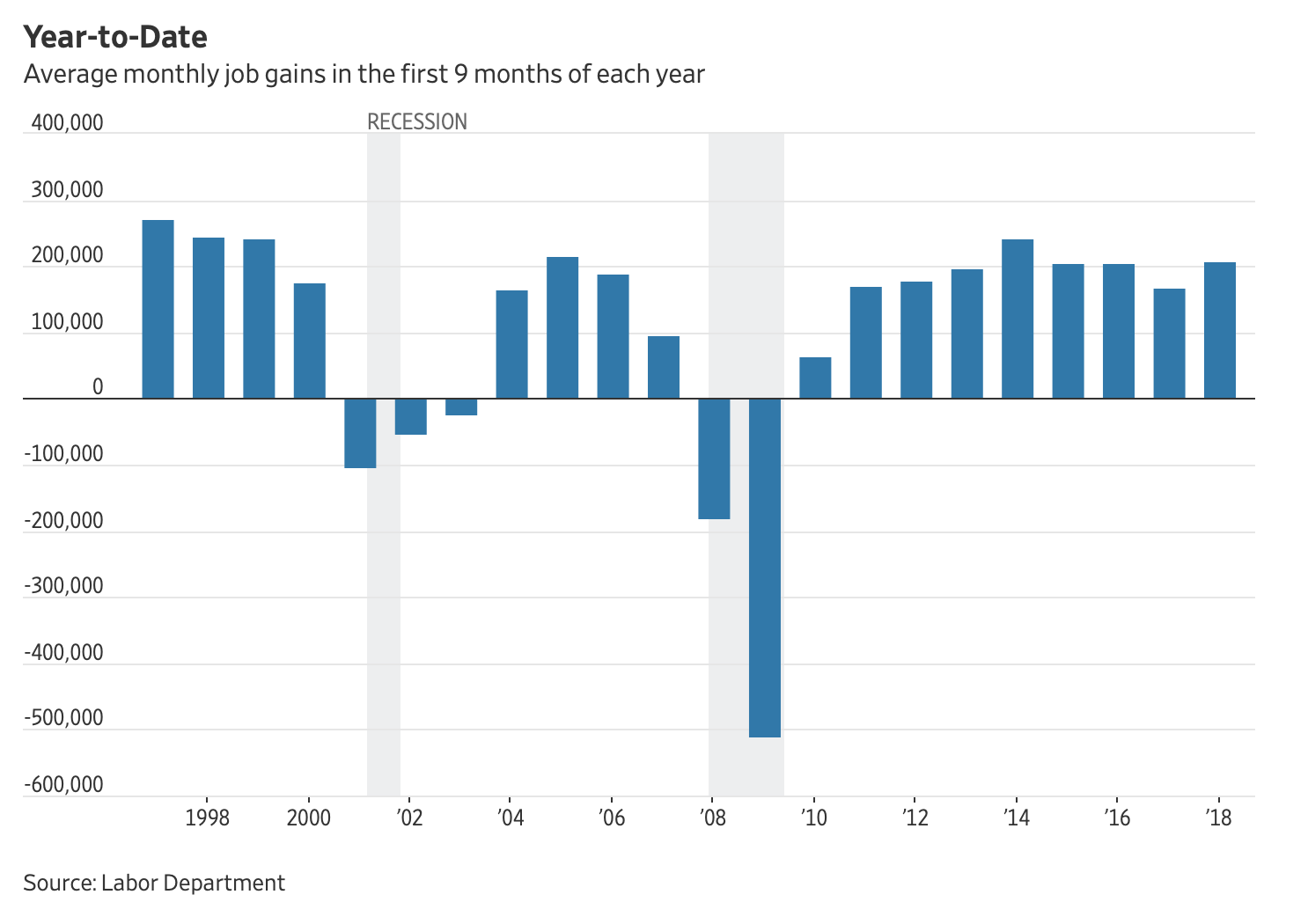

So why did rates spike so much? The simple answer is that this morning's economic data drove home some of the harsh realities that have been plaguing rates in general for the past few years--and especially over the past 2 months. Simply put, when the economy is firing on all cylinders and when traders have reason to defend against the possibility of even faster growth and inflation (something today's data may well suggest), rates are forced to move higher.

The complicated part of the answer has to do with the extra momentum that can creep into underlying market movements on days like today. To an undetermined extent, traders are definitely positioning for more unfriendly rate news with Friday morning's big jobs report. That's our first major opportunity for reprieve, but reprieve should not be taken for granted. Rates could go even higher if Friday's data strikes a similar chord to today's.

Loan Originator Perspective

Bond markets tanked today on robust economic and employment data. We're looking at treasury yields that haven't been seen since 2011, with no end to the losses in sight. I have been locking early for months, and today's a great illustration of why. Since rate sheets don't yet reflect today's market losses, locking now (instead of waiting for tomorrow) is the move here. -Ted Rood, Senior Originator

Today's Most Prevalent Rates

- 30YR FIXED - 4.875-5.0%

- FHA/VA - 4.5%

- 15 YEAR FIXED - 4.375-4.5%

- 5 YEAR ARMS - 4.25%-4.75% depending on the lender

Ongoing Lock/Float Considerations

- Rates continue coping with several big-picture headwinds, including: the Fed's rate hike outlook (and general policy tightening), the increased amount of Treasury issuance to pay for the tax bill (higher bond issuance = higher rates), and the possibility that fiscal stimulus results in higher growth/inflation (which certainly seems to be the case so far in 2018).

- While rates were able to recover and stay sideways in the summer months, September and October have seen a surge up to the highest levels in more than 7 years.

- Upward pressure can continue as long as economic growth and inflation continue running near long-term highs. Stay defensive (i.e. generally more lock-biased). It will take a big change in economic fundamentals or geopolitical risk for the big picture to change. Such things tend to not happen as quickly as we'd like.

- Rates discussed refer to the most frequently-quoted, conforming, conventional 30yr fixed rate for top tier borrowers among average to well-priced lenders. The rates generally assume little-to-no origination or discount except as noted when applicable. Rates appearing on this page are "effective rates" that take day-to-day changes in upfront costs into consideration.