New Year, New Home? Set Homeownership Goals Whether You’re Buying, Selling, or Staying Put

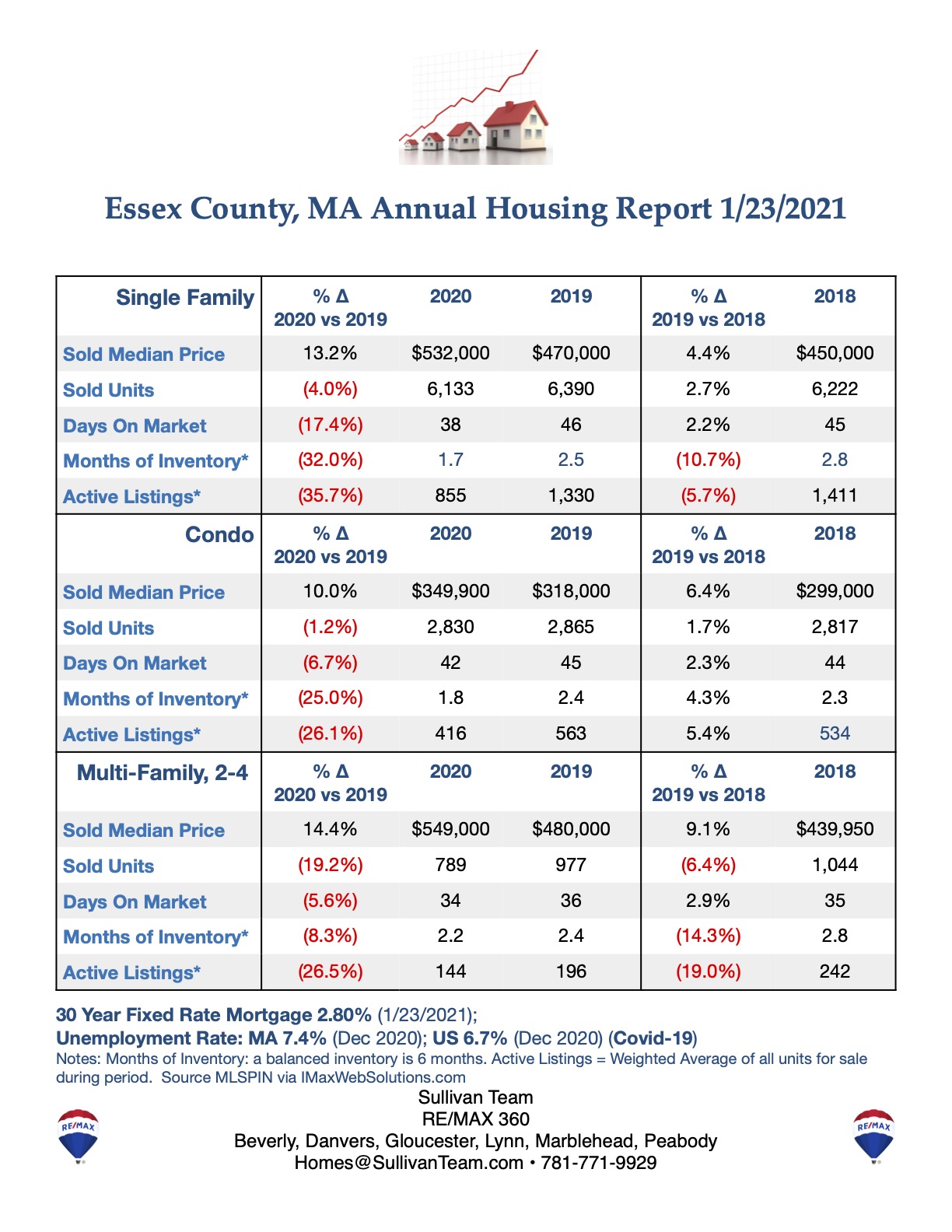

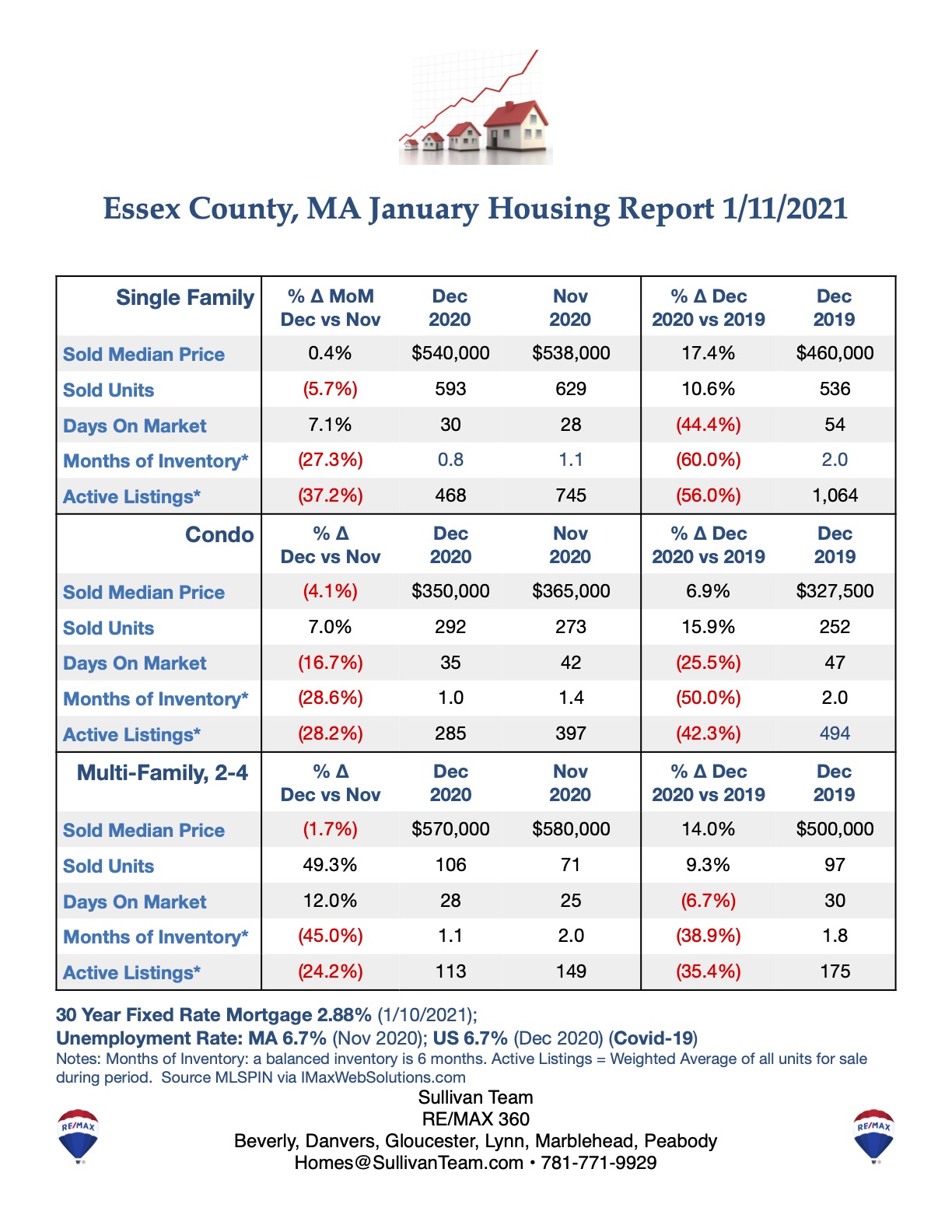

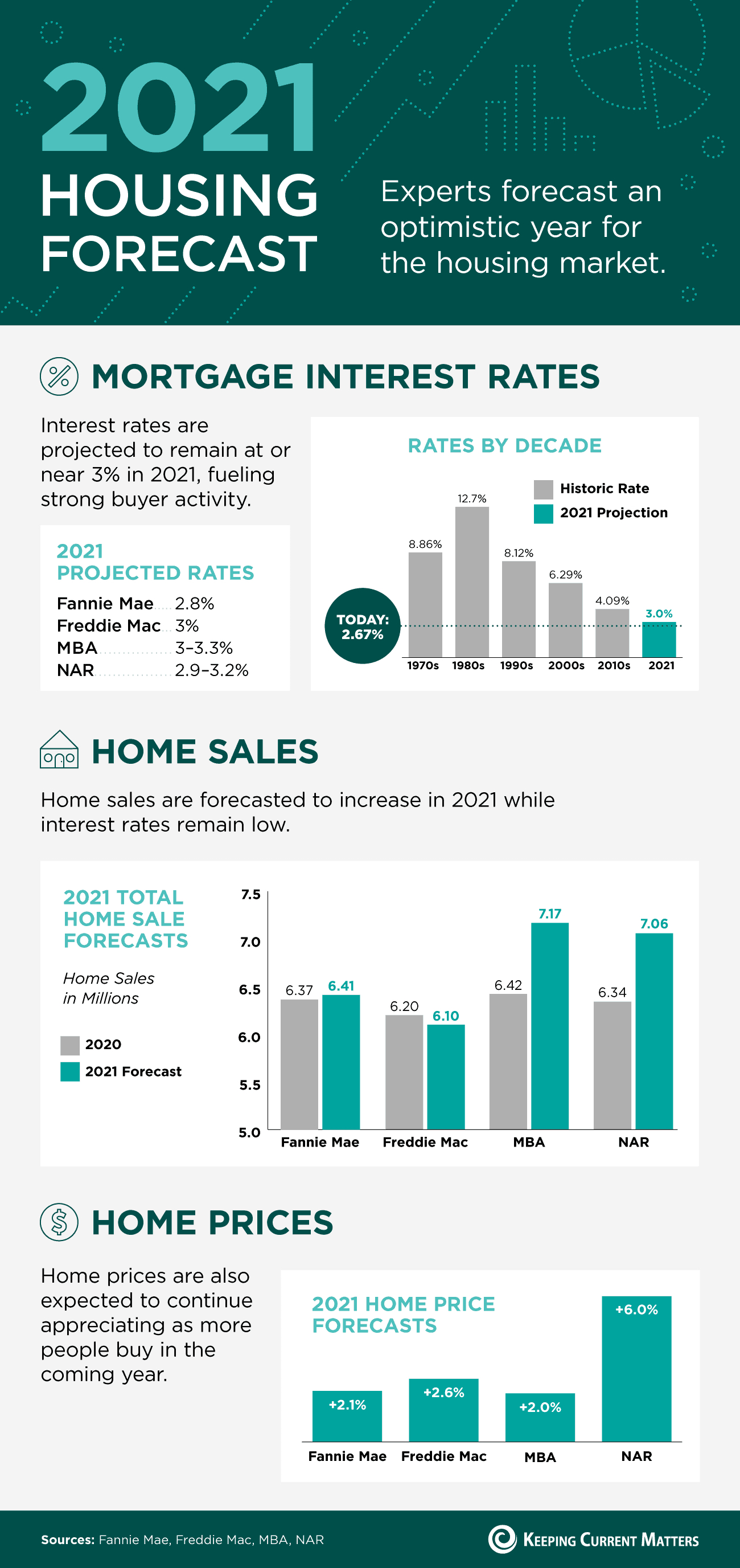

The start of a new year always compels people to take a fresh look at their goals, from health and career to relationships and finance. But with historically low mortgage rates, increased home sales and price growth, and a tight housing inventory, the time is right to also make some homeownership resolutions for 2021.

Home buyers, is this the year you work to improve your credit score, pay down some debt, or save for a down payment?

Home sellers, we’ve laid out plans for you to get top dollar for your property, including timing your home sale, making your property stand out from the crowd, and investing in your extra living space.

And even if you’re staying put for awhile, homeowners, you can resolve to improve your status quo by evaluating your home budget, finalizing your home maintenance schedule, or maybe investing in a second property.

So no matter your homeownership status, we’ve got some ideas and advice for you to make this year your best one yet. Read on to learn more.

HOME BUYERS

Resolution #1: Qualify for a better mortgage with a higher credit score.

Your credit report highlights your current debt, bill-paying history, and other key financial information. Importantly for your home-buying journey, it is also used by lenders and companies to calculate your credit score, which partly determines if you are qualified to obtain a mortgage. Therefore, before you start house-hunting, make sure your finances are in the best possible shape by checking your credit report from Equifax, Experian, and TransUnion (via AnnualCreditReport.com). You can also obtain your credit score for free from some banks and credit card companies.

Your credit score will be a number ranging from 300-850.1 Generally speaking, a credit score of 740 or higher is considered very good to excellent.2 If your FICO score drops below 740, you might need to work at boosting your score for a few months before you begin house-hunting. Ways to do this are to pay your bills on time every month, keep your credit card balances low, and avoid applying for new credit.

Resolution #2: Improve your credit health by paying down debt.

Do you have student loans, credit card debt, or car payments tying up your income each month? That debt is hurting your “buying power,” or the amount of home you can afford. Not only is it money that you can't spend on your new home, but your debt-to-income ratio also affects your credit score, which we discussed above. The less debt you have, the higher your FICO score and the better mortgage you can obtain.

If you can, pay off some debt in its entirety—like a low balance on a credit card. Then apply that "extra" money you previously paid on that credit card to pay off bigger debt, like a car loan. Even if you can’t pay off all (or any) of your debt in full, reducing the balances of each account will help you qualify for the best possible mortgage terms.

Resolution #3: Create a financial safety net before applying for a mortgage.

Don’t forget that buying a home requires some cash as well. A down payment is typically 7% of a home’s purchase price, and closing costs currently average $3,700.3,4 You’ll also need money for moving expenses and any initial maintenance tasks that might pop up. And as the pandemic taught us, you never know when an unforeseen event might cause a job loss, drop in income, or health scare, so having some liquid savings will ensure that you can still pay your mortgage if a crisis occurs.

Dedicate some effort to building up your reserves. Cut down on unnecessary expenses, and consider having a portion of each paycheck automatically deposited into your savings account to avoid the temptation to spend it.

HOME SELLERS

Resolution #4: Decide on the right time to sell your home.

If you’re looking to maximize profit on the sale of your home, selling earlier in the year makes sense. Listing prices historically increase early in the year, peak in May, plateau through June, and decrease for the remainder of the year.5And, according to the National Association of Realtors, “[w]ith both mortgage rates and the number of homes available for sale expected to remain relatively low, home prices are likely to continue to increase. [In] mid-January, home prices typically begin a quick ramp-up in a normal year.”5

But sales price isn’t the only thing to consider. You might not be ready to sell your home yet because you don't want to uproot your kids during the school year or because you need to tackle some minor upgrades before placing your home on the market.

This means that there is no one month or season that is the perfect time to sell your home. Instead, the right timeline for you takes into account factors such as when you’ll earn the highest profit, personal convenience, and whether your home is even ready to put on the market. A trusted real estate professional can talk you through your specific needs to clarify when to sell your home.

Resolution #5: Boost your home’s resale value by making your property shine.

Housing inventory is at historic lows across the country, and that means the market is fiercely competitive.6 Selling your home in 2021 has the potential to net you a huge return right now, and you can maximize that amount with some simple fixes to make sure your property outshines your neighbors' for sale down the street.

In your home, you might need to tackle a minor remodeling project, such as upgrading the flooring or adding a fresh coat of paint. According to the National Association of Realtors’ 2019 Remodeling Impact Report, simply refinishing existing hardwood floors recoups 100% of the cost at resale, and completely replacing it with new wood flooring recovers 106% of costs.7

Outside, you might consider improving your curb appeal by removing a dead bush, trimming a tree that blocks the front window, or power-washing your moldy driveway and sidewalks. In fact, real estate agents say cleaning the exterior of your house can add $10,000 to $15,000 to a home’s sale price.8 And according to a Virginia Tech study, improving a home’s landscaping may increase its value by 10 to 12%.9

A good agent should provide custom-tailored suggestions to ensure your property pops inside and out. Ask us about our local insider secrets that will make your home stand out from others on the market.

Resolution #6: Invest in your “extra” living space to meet current buyers’ needs.

Due to COVID-19, more people are staying at home to work, go to school, exercise, and stay entertained. And these lifestyle changes are showing up in home buyer preferences. For example, according to one study, buyers are looking more and more for homes with formal, outfitted home offices, private outdoor spaces, and updated kitchen appliances.10

So if you’ve got an underutilized room, consider turning it into an office, home gym, schoolroom, or multi-purpose room to meet current home buyer needs and attract better offers on your home. Got some underwhelming space outside? You could turn it into an outdoor entertainment area by adding a firepit, upgrading the patio furniture, or installing a grilling area. Be sure to consult with a local real estate professional before investing in a renovation, however, as each market’s buyers have different tastes.

HOMEOWNERS

Resolution #7: Evaluate your household budget to reflect financial changes.

After this past year, in particular, your financial picture may have changed. Maybe you were furloughed, had your hours reduced, or got a new job further from home. Perhaps you’ve kept the same job, but you’re now working remotely. A work-from-home arrangement could mean less money spent on gas, tolls, a professional wardrobe, and dining out for lunch.

But this could also mean new (or increased) expenses now that you’re working at home, such as new tech-related purchases, faster Wi-Fi, and higher energy bills. January marks the perfect opportunity to update your income and expenses and review last year’s spending habits, tweaking as needed for 2021.

For more specific ideas, contact us for our free report "20 Ways to Save Money and Stretch Your Household Budget."

Resolution #8: Save money now (and earn more later) with a home maintenance plan.

Having a schedule of regular home maintenance projects to tackle will save you money now and in the long-term. You’ll avoid some surprise “emergency fixes,” and when you’re ready to eventually sell your home, you’ll get higher offers from buyers who aren’t put off by overdue repairs.

Even if nothing necessarily needs fixing right now, you can lower your energy costs by maintaining and upgrading your home. According to the U.S. Department of Energy, simple fixes add up: replace five most frequently used bulbs with ENERGY STAR ones to save $75/year; repair leaky faucets to save $35/year; replace older toilets with low-flow models to save $100/year; and seal air leaks to save $83-$166/year.11

For a breakdown of home maintenance projects to tackle throughout the year, contact us for our free report “House Care Calendar: A Seasonal Guide to Maintaining Your Home.”

Resolution #9: Invest in real estate for a better standard of living.

Even if you don’t plan on leaving your current residence, real estate is a great way to improve your quality of life in 2021.

Have cabin fever from the long quarantine? A vacation home in a getaway location you love lets you safely spread your wings. And if you have been looking for a second stream of income, an investment property might be your answer. Just be sure to consult with a real estate professional to get a realistic sense of a property’s true income potential.

Want more information on how a second property fits into your 2021 plans? Request our free report, "Move Up vs Second Home: Which One Is Right For You?"

LET US HELP YOU WITH YOUR 2021 GOALS

Without a plan and a support system, 55% of Americans will break their new year’s resolutions.12 Whether you’re looking to buy, sell, or stay put in your home, it helps to connect with a trusted real estate agent to keep you motivated and on track.

As local market experts, we have the knowledge, experience, and networks to help you achieve your homeownership goals, whatever they may be. Reach out to us today for a free consultation and commit to a happy and prosperous new year.

Sources:

- USA.gov -

https://www.usa.gov/credit-report

- Equifax -

https://www.equifax.com/personal/education/credit/score/what-is-a-good-credit-score/

- NerdWallet -

https://www.nerdwallet.com/article/mortgages/the-20-mortgage-down-payment-is-dead

- Zillow -

https://www.zillow.com/mortgage-learning/closing-costs/

- Realtor.com -

https://www.realtor.com/research/we-should-be-in-a-buyers-market-right-now-but-covid-turned-everything-upside-down-best-time-to-buy-a-home

- Business Insider -

https://www.businessinsider.com/how-2020-broke-the-housing-market-inventory-could-run-out-2020-9

- National Association of Realtors -

https://www.nar.realtor/sites/default/files/documents/2019-remodeling-impact-10-03-2019.pdf

- House Logic -

https://www.houselogic.com/save-money-add-value/add-value-to-your-home/adding-curb-appeal-value-to-home/

- Virginia Cooperative Extension -

https://www.pubs.ext.vt.edu/content/dam/pubs_ext_vt_edu/426/426-087/426-087.pdf

- HomeLight -

https://www.homelight.com/blog/top-agent-insights-for-q2-2020/

- U.S. Department of Energy -

https://www.energy.gov/energysaver/articles/how-much-can-you-really-save-energy-efficient-improvements

- Ipsos -

https://www.ipsos.com/en-us/urban-plates-ipsos-NY-Resolutions